Increase Your Score: Efficient Techniques for Credit Repair Revealed

Increase Your Score: Efficient Techniques for Credit Repair Revealed

Blog Article

Comprehending Exactly How Debt Repair Works to Improve Your Financial Health

The procedure incorporates determining errors in credit score reports, contesting mistakes with credit report bureaus, and bargaining with lenders to attend to superior financial obligations. The question stays: what specific strategies can people use to not just remedy their credit report standing however additionally make sure long lasting monetary security?

What Is Credit Score Repair Service?

Credit scores fixing refers to the procedure of enhancing an individual's credit reliability by dealing with inaccuracies on their credit score record, negotiating financial obligations, and taking on far better financial practices. This diverse strategy aims to improve an individual's credit score, which is an important consider securing financings, bank card, and favorable rates of interest.

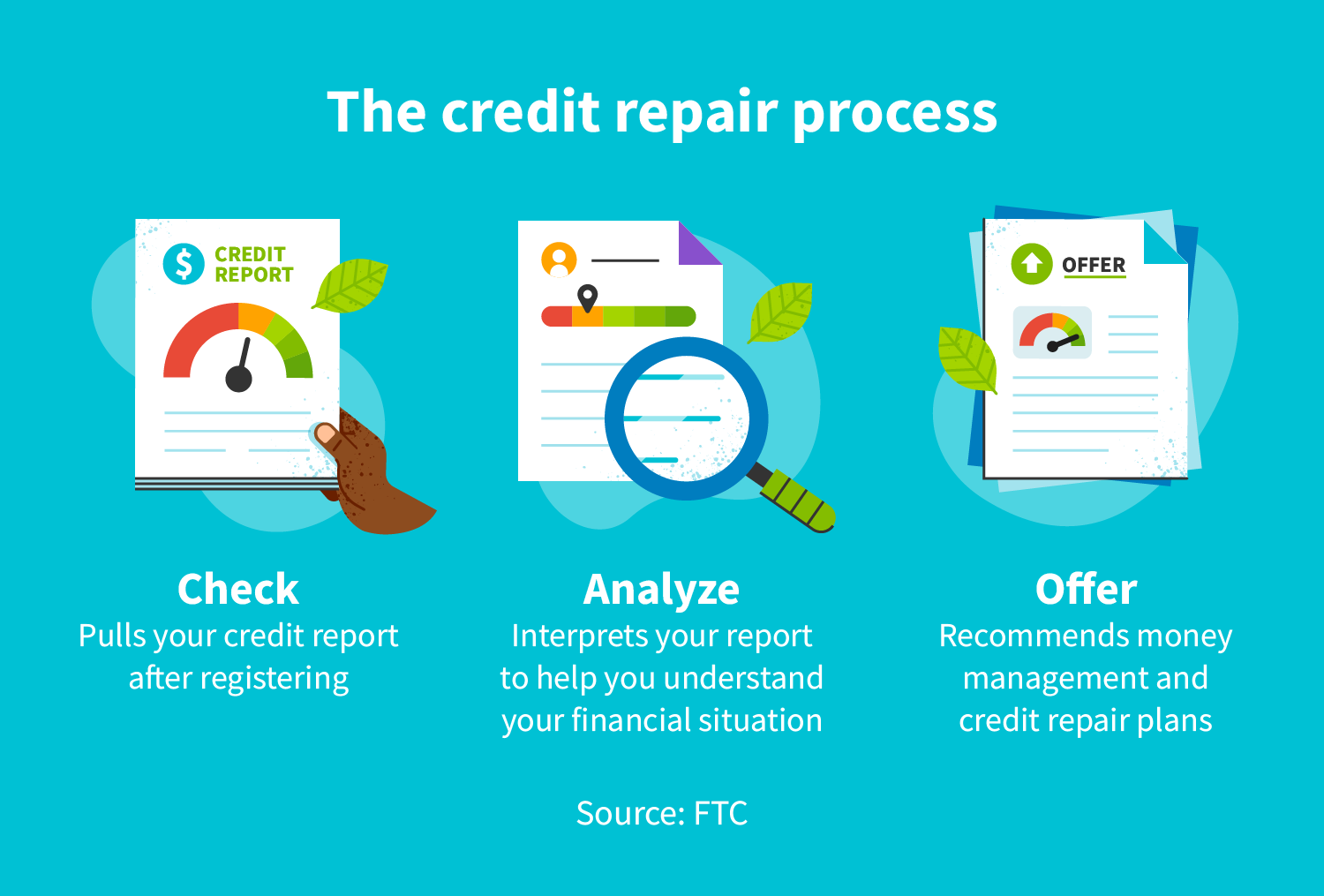

The credit score fixing process generally begins with an extensive evaluation of the person's credit report, enabling the recognition of any kind of disparities or errors. The private or a credit score fixing professional can initiate conflicts with credit score bureaus to remedy these issues when inaccuracies are determined. Furthermore, working out with creditors to settle arrearages can even more enhance one's financial standing.

In addition, adopting prudent economic practices, such as prompt expense payments, minimizing credit application, and maintaining a varied credit report mix, contributes to a much healthier credit history profile. Generally, credit scores fixing acts as an important technique for individuals looking for to restore control over their economic health and safeguard better borrowing possibilities in the future - Credit Repair. By engaging in credit fixing, individuals can lead the way toward attaining their financial objectives and boosting their general lifestyle

Typical Credit Rating Record Mistakes

Errors on credit score reports can dramatically impact a person's credit rating, making it crucial to understand the typical sorts of inaccuracies that might develop. One prevalent problem is wrong personal info, such as misspelled names, incorrect addresses, or inaccurate Social Safety numbers. These mistakes can cause complication and misreporting of creditworthiness.

Another typical mistake is the coverage of accounts that do not come from the individual, often because of identification burglary or clerical errors. This misallocation can unfairly reduce an individual's credit rating score. In addition, late payments might be erroneously tape-recorded, which can take place because of settlement handling mistakes or incorrect coverage by lenders.

Credit limits and account equilibriums can also be misstated, causing an altered sight of a person's credit score use proportion. Furthermore, outdated information, such as shut accounts still looking like active, can adversely affect debt assessments. Public records, consisting of bankruptcies or tax obligation liens, might be erroneously reported or misclassified. Awareness of these typical errors is critical for effective debt management and repair, as addressing them immediately can assist individuals maintain a much healthier monetary profile.

Actions to Conflict Inaccuracies

Contesting mistakes on a credit report is a crucial procedure that can aid recover an individual's credit reliability. The initial step entails acquiring a present copy of your credit history report from all 3 significant credit bureaus: Experian, TransUnion, and Equifax. Testimonial the record meticulously to determine any kind of errors, such as wrong account details, balances, or settlement backgrounds.

Next, initiate the dispute process by speaking to the relevant credit scores bureau. When sending your disagreement, clearly lay out the errors, give your evidence, and include personal identification information.

After the conflict is filed, the credit scores bureau will certainly check out the insurance claim, normally within 30 days. Maintaining precise records throughout this procedure is crucial for efficient resolution and tracking your credit score health.

Building a Strong Debt Account

Exactly how can people properly cultivate a durable credit account? Developing a strong credit profile is necessary for protecting desirable monetary opportunities. The foundation of a healthy credit report account starts with timely expense payments. Regularly paying bank card bills, loans, and other obligations on time is crucial, as repayment background significantly affects credit report.

Furthermore, preserving low credit score application ratios-- preferably under 30%-- is important. This means keeping bank card equilibriums well listed below their limitations. Diversifying credit report kinds, such as a mix of rotating credit report (credit report cards) and installation loans (vehicle or home finances), can additionally boost credit scores accounts.

Regularly keeping an eye on credit scores reports for errors is just as essential. Individuals need to assess their credit report reports at the very visit this site least every year to determine disparities and dispute any mistakes immediately. In addition, avoiding excessive credit history questions can avoid potential unfavorable impacts on credit report.

Lasting Advantages of Credit Score Repair Service

In addition, a more powerful credit report account can help with better terms for insurance policy premiums and even affect rental applications, making it much easier to safeguard real estate. The mental advantages must not be neglected; people that effectively fix their credit history usually experience lowered address tension and improved confidence in managing their funds.

Verdict

Finally, credit scores repair works as a vital system for improving economic health. By determining and challenging inaccuracies in credit rating reports, people can remedy errors that adversely influence their credit scores. Establishing audio financial techniques additionally contributes to developing a robust credit profile. Ultimately, effective debt repair work not just helps with access to much better lendings and lower rate of interest prices but likewise fosters lasting financial security, thereby promoting overall economic well-being.

The lasting advantages of debt repair service prolong much past simply enhanced credit rating scores; they can considerably enhance a person's overall financial health and wellness.

Report this page